#accounting_rate_of_return

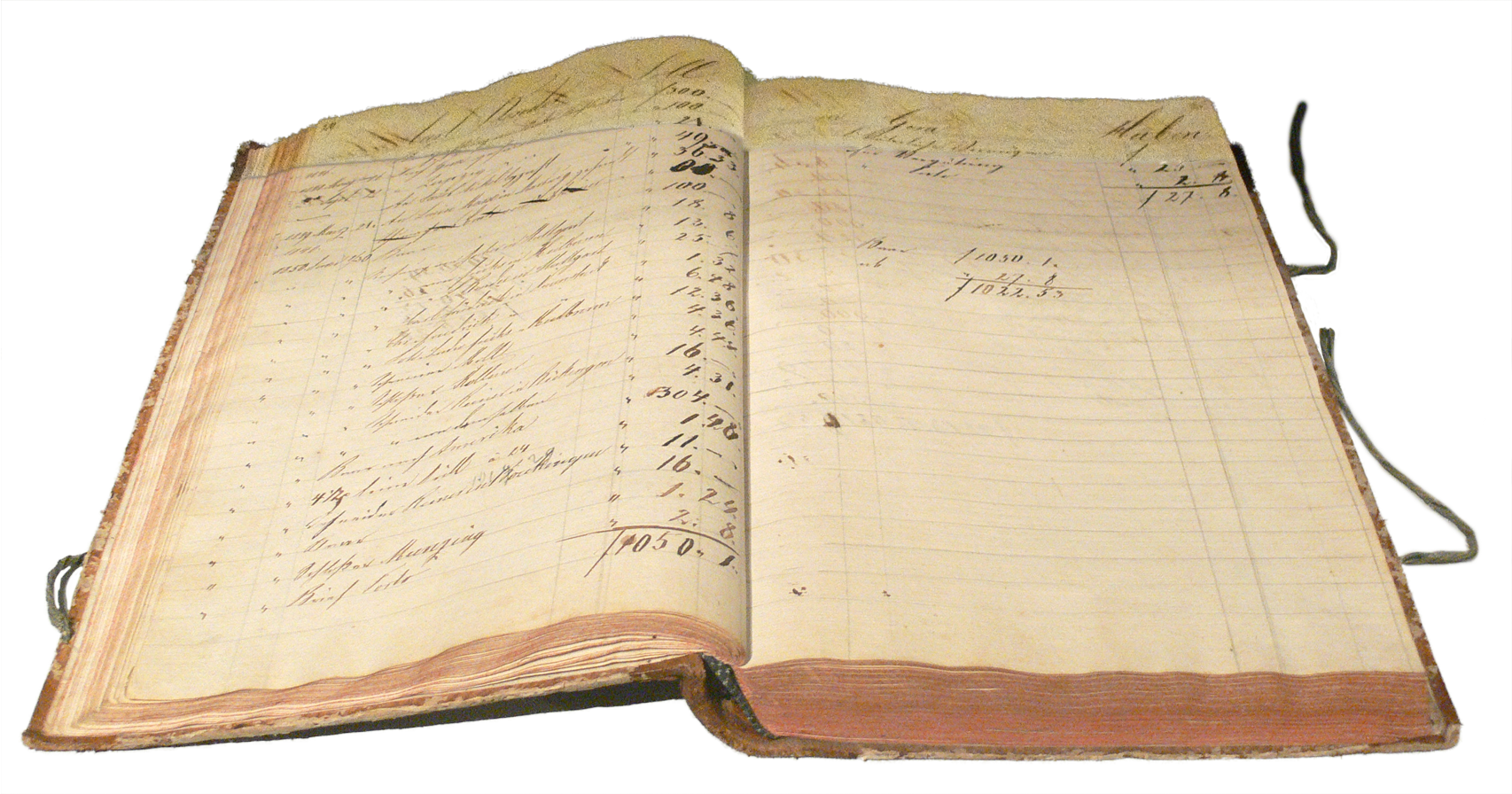

Accounting rate of return

The accounting rate of return, also known as average rate of return, or ARR, is a financial ratio used in capital budgeting. The ratio does not take into account the concept of time value of money. ARR calculates the return, generated from net income of the proposed capital investment. The ARR is a percentage return. Say, if ARR = 7%, then it means that the project is expected to earn seven cents out of each dollar invested (yearly). If the ARR is equal to or greater than the required rate of return, the project is acceptable. If it is less than the desired rate, it should be rejected. When comparing investments, the higher the ARR, the more attractive the investment. More than half of large firms calculate ARR when appraising projects.

Fri 23rd

Provided by Wikipedia

This keyword could refer to multiple things. Here are some suggestions: